India Income Tax E Filing

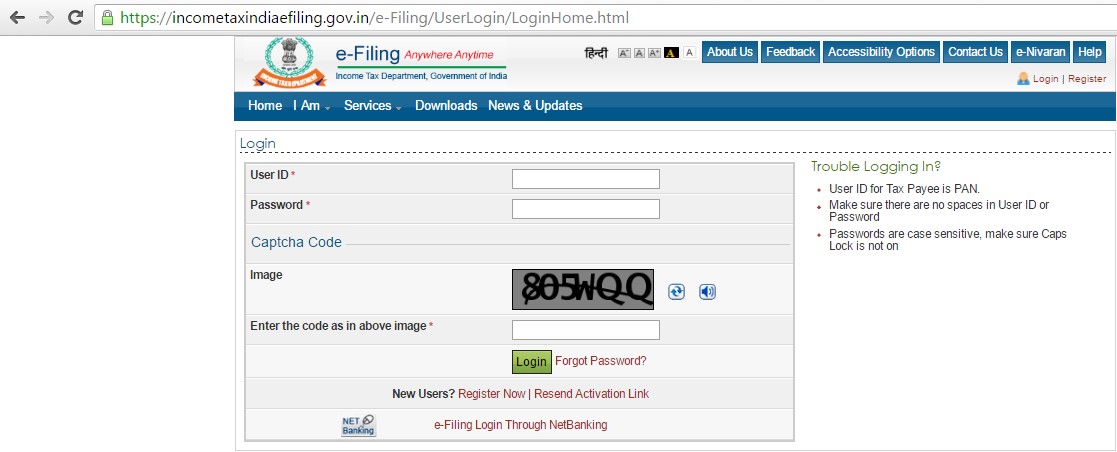

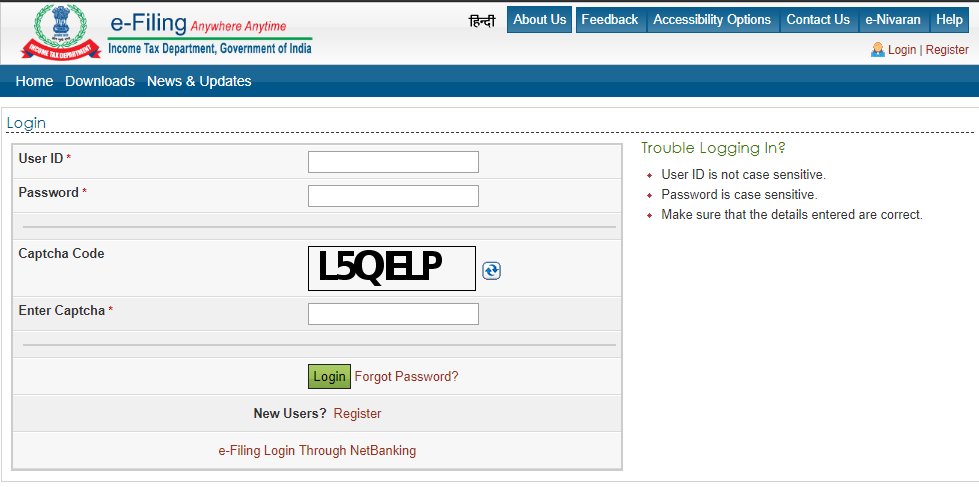

Visually challenged users can use the below otp option instead of image captcha otp will be sent to the mobile number registered with e filing.

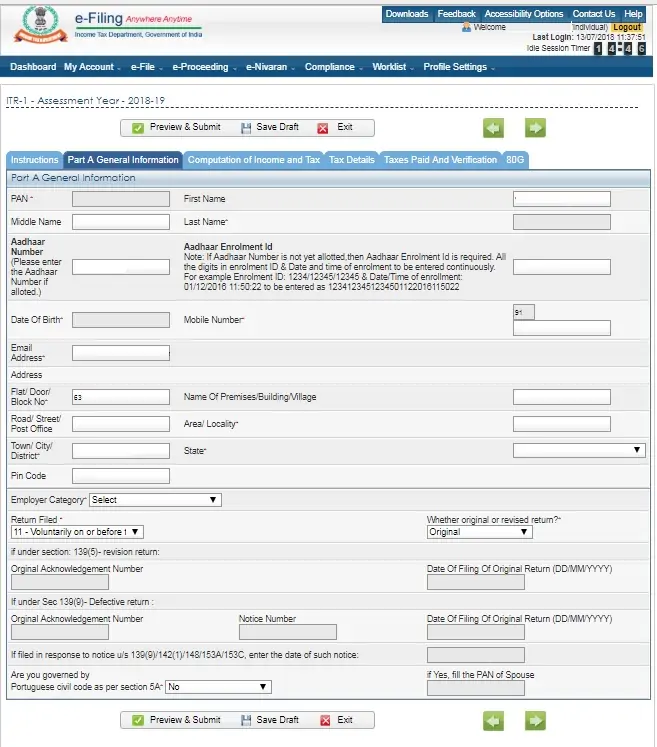

India income tax e filing. To avoid penalties or scrutiny from the tax department one could opt hassle free environment at e tax filing india portal for income tax return filing online. Form 16 payslips for salaried employee 2. If this concern you most you can even file income tax return via e tax filing india portal. Under existing income tax rules in india e filing is currently mandatory for most tax assessees and replaces the earlier paper based system of filing itr.

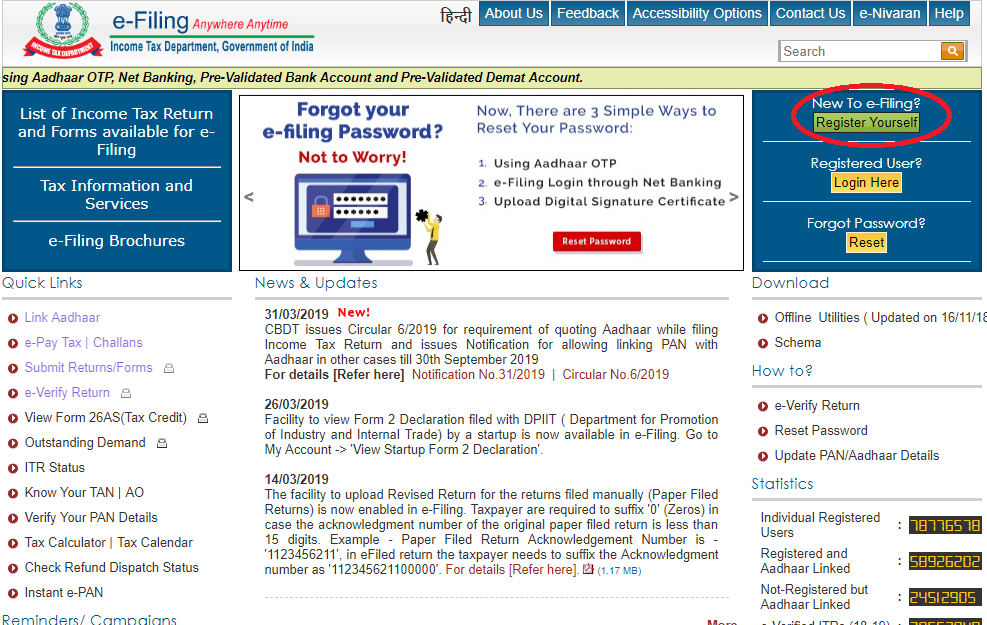

If you are not registered with the e filing portal use the register yourself link to register. Financial data tally data if available income from business profession. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. From financial year 2017 18 rs 10 000 would be levied for non filing of itr.

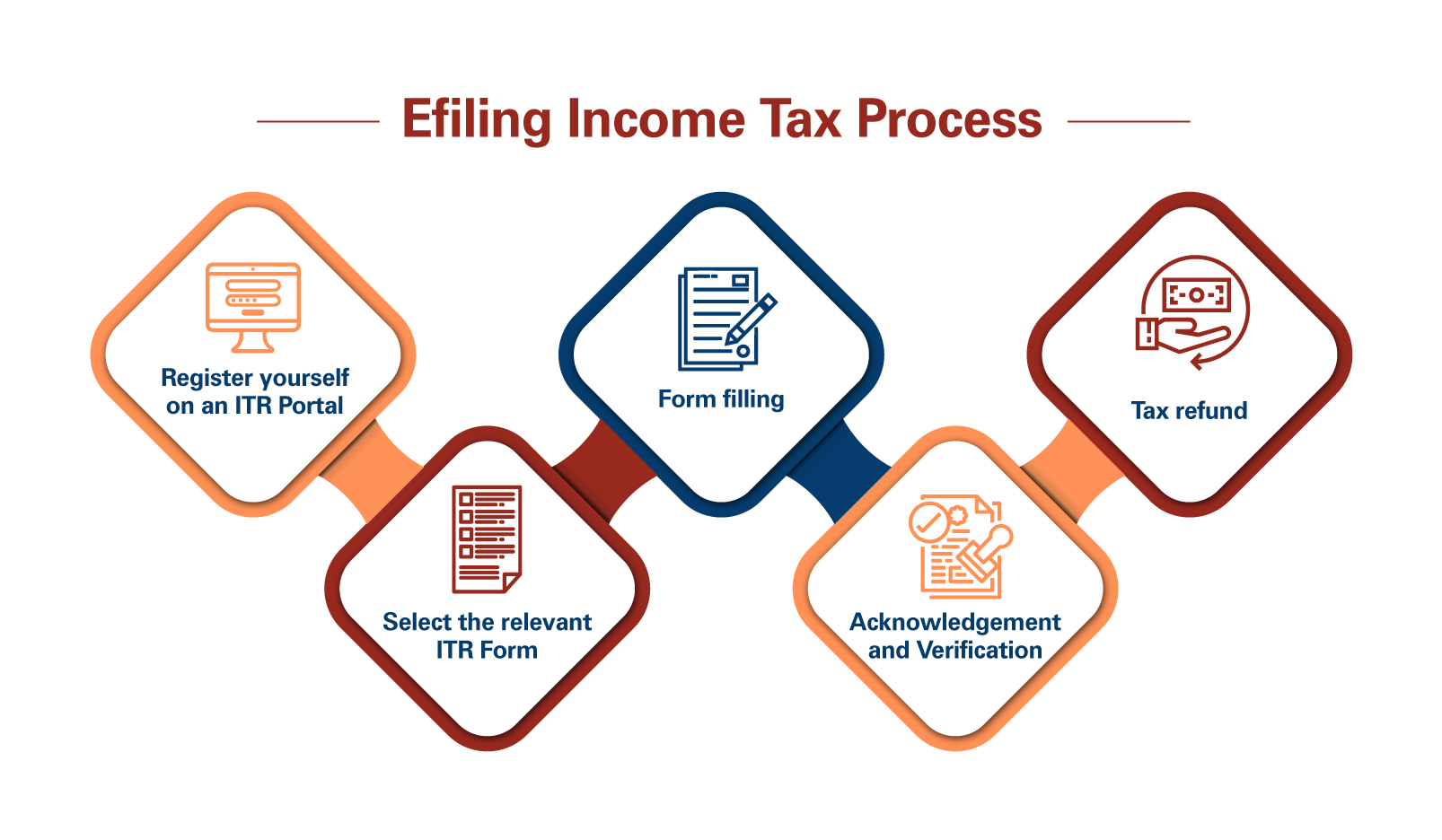

You may be one of them. In 2014 income tax department has identified additional 22 09 464 non filers who have done high value transactions. Documents required for income tax return e filing in india. Go to the official website of the income tax department keep your pan card handy to complete the registration quickly.

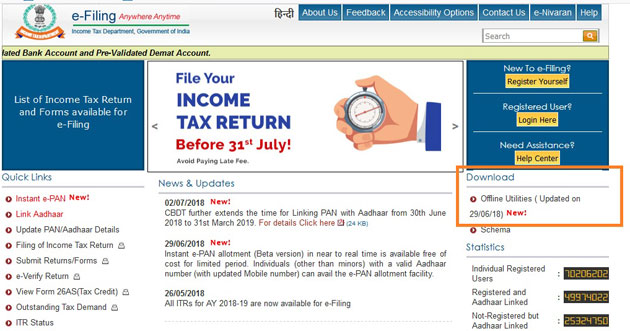

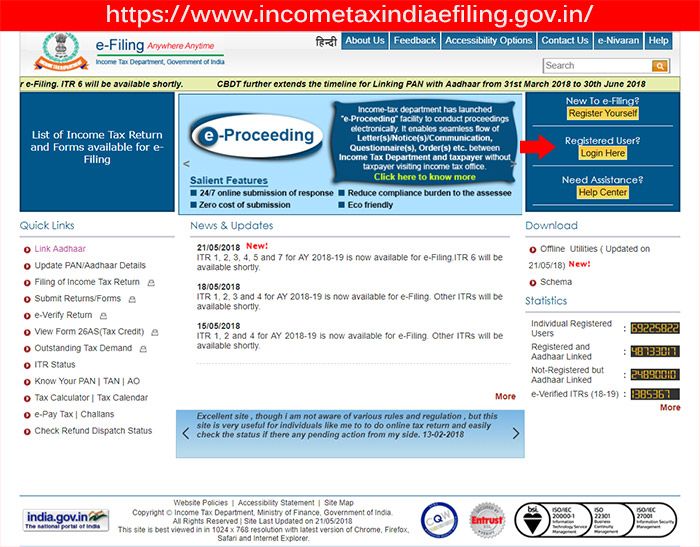

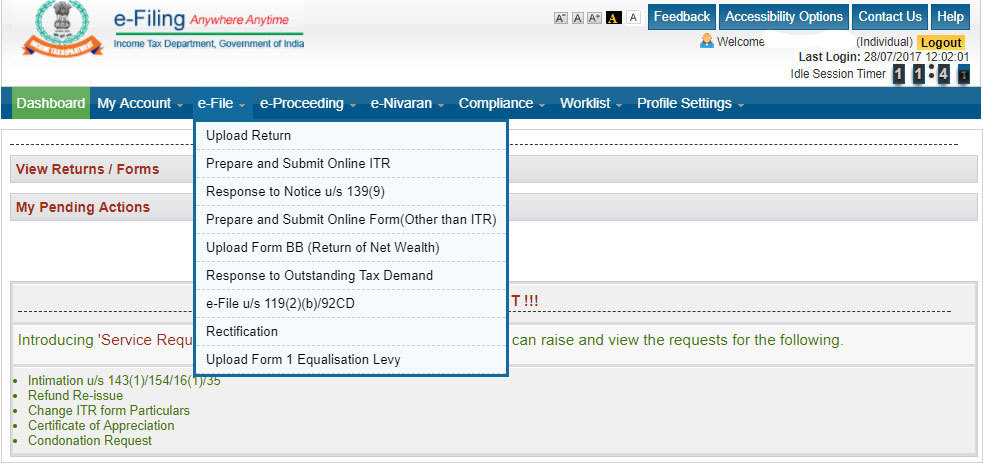

Log on to e filing portal at https incometaxindiaefiling gov in. The last date of e filing income tax return for ay 2019 20 is 31st august 2019 extended from the original deadline of 31st july 2019. Income tax return e filing anywhere anytime through online legal india filing returns is a sign you are responsible the government mandates that individuals who earn a specified amount of annual income must file a tax return within a pre determined due date. With the income tax return e filing option you can file your taxes easily.

List of income tax return and forms available for e filing cbdt extends the time for linking pan with aadhaar from 31st august 2017 to 31st december 2017 taxpayer submitting income tax return for assessment year 2017 18 to ensure incomes receipts and deduction claimed matches with form 16 16a issued by deductor. Seamless e filing facility for uploading of income tax returns anywhere and anytime around the clock about 2 00 00 000 returns filed till 31st aug 15 in current financial year automated ecosystem for processing of returns capacity peak 5 lakh returns per day average processing time reduced from 12 to 14 months to 55 days.