India Income Tax E Filing For Nri

Central board of direct taxes has given the powers to income tax authorities to accept the income tax return for a financial year even after the expiry of due date of the same by using its powers as laid down under section 119 2 b of the income tax act.

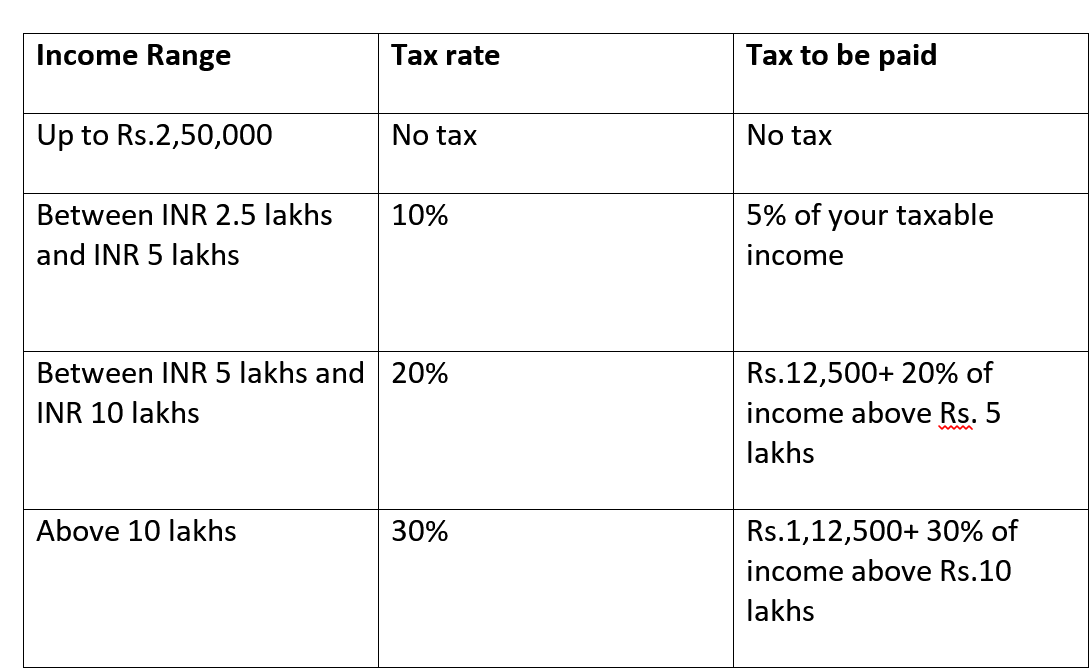

India income tax e filing for nri. Nri or not any individual whose income exceeds rs 2 50 000 is required to file an income tax return in india. Income earned whether in india or outside india is taxable in india. While this may ring alarm bells for many nris but in a relief they will be treated as resident but not ordinarily resident rnor. However if income is less than the basic.

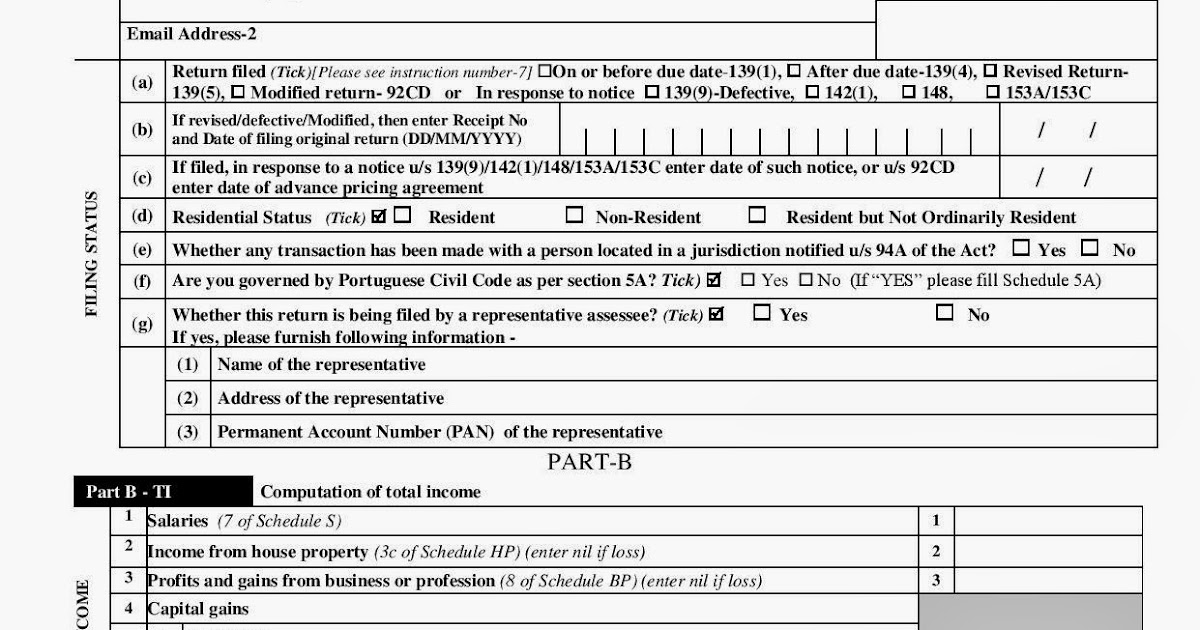

For instance if an nri has only exempt long term capital gains income of 585 000 and has no income from other sources. After you have determined your residential status the next step is to identify whether your income is taxable or not in india as per your residential status determined under income tax act 1961. Every year cbdt notifies the new itr forms to be in line with the amendment in the relevant finance act i e. When is a nri compulsorily liable to file a return of income roi in india.

Also called non resident indian they give a boost to indian economy in various ways including paying tax. The obligation of an nri to file income tax depends on their residential status. A nri is liable to file roi if his her taxable income in india during the relevant financial year f y 1 st april to 31 st march exceeds the basic exemption limit i e. In case the taxable income of an nri is less than the basic exemption limit but the exempt income is more than the basic exemption limit i e.

Am i required to file my income tax return in india. Your global income is taxable in india i e. Interest earned on an nre account and fcnr account is tax free. Finance act 2019 in relation to fy 2019 20 itrs.

In 2013 income tax department issued letters to 12 19 832 non filers who had done high value transactions. An nri s guide to tax e filing in india. In 2014 income tax department has identified additional 22 09 464 non filers who have done high value transactions. You may be one of them.

In such a case he will be treated as a resident individual for income tax purposes. Further under the india income tax law an individual who qualifies as an nri is required to file india tax returns if the taxable income exceeds the maximum amount not chargeable to income tax. 250 000 then also he she is required to file his her income tax return. Some of the salient features changes of these forms are.

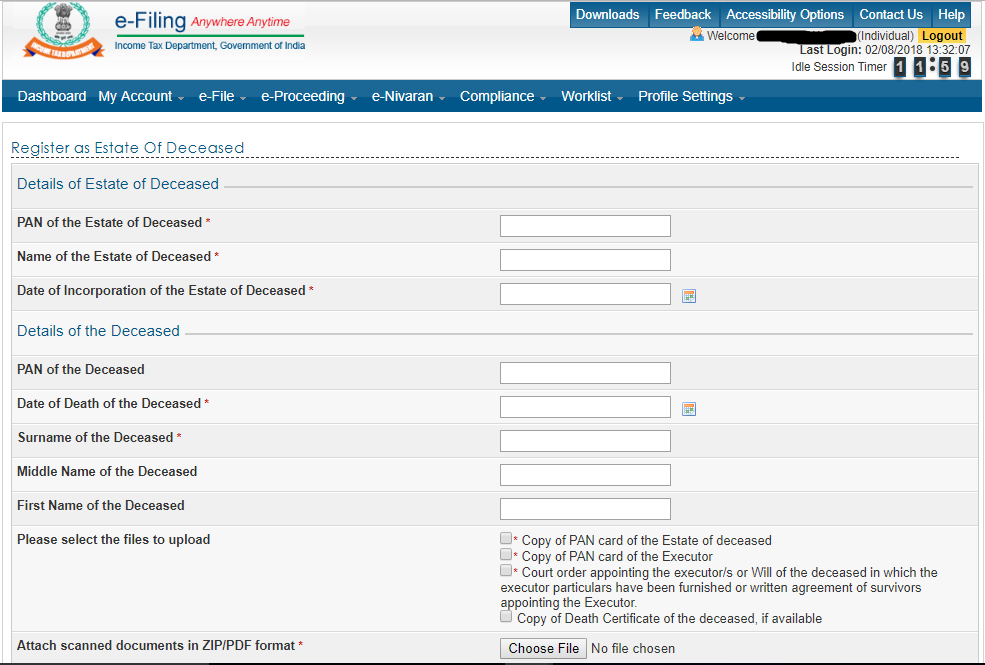

This would be a relief as their foreign income i e income accrued outside india shall not be taxable in india. Log on to e filing portal at https incometaxindiaefiling gov in. Income which is earned outside india is not taxable in india. Interest on nro account is taxable for an nri.

A non resident indian is an individual of indian origin or a citizen of india who resides outside india.